This August, Future Horizon brings you fresh insights into the semiconductor industry. Dive into the latest market trends and outlook below.

Executive Summary

Annualised growth rates retreated again slightly in June, with Total Semiconductors growing 18.0 percent, down from last month’s 18.2 percent and April’s 22.9 percent and, whilst still in respectably high double-digit growth terrain, was still sizeably down from August 2024’s 28.5 percent cyclical peak.

All three sectors performed well in June, with Total ICs continuing their lead as the prime industry growth driver at a healthy 19.8 percent, albeit down from 21.2 percent in May and 25.2 percent in April, with Opto at 6.8 percent and Discretes at 6.2 percent, vs. last month’s minus 6.6 percent and plus 5.2 percent respectively.

Whilst the overall semiconductor market still showed a strong double-digit growth, the overall trend is flat, at around the 20 percent level, varying from August 2024’s 36.2 percent peak to January 2025’s 14.8 percent low.

These peaks do not last forever, nor do they turn up, and we continue to expect to see this trend turn down in the coming months, as per past cyclical patterns, with the only uncertainty being as to when this will happen.

Forecast Update

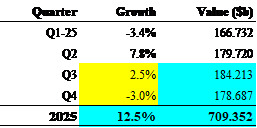

With the June results now in, at 7.4 percent overall quarter-on-quarter growth, the second quarter romped home a lot stronger than anyone predicted, either by earlier company guidance, which ranged from minus 10.7 percent (Kioxia) to plus 14.6 percent (SK Hynix), historical second quarter trends, or our 1.4 percent forecast.

2025 SC Growth By Quarter

(US$)

Source: WSTS/Future Horizons

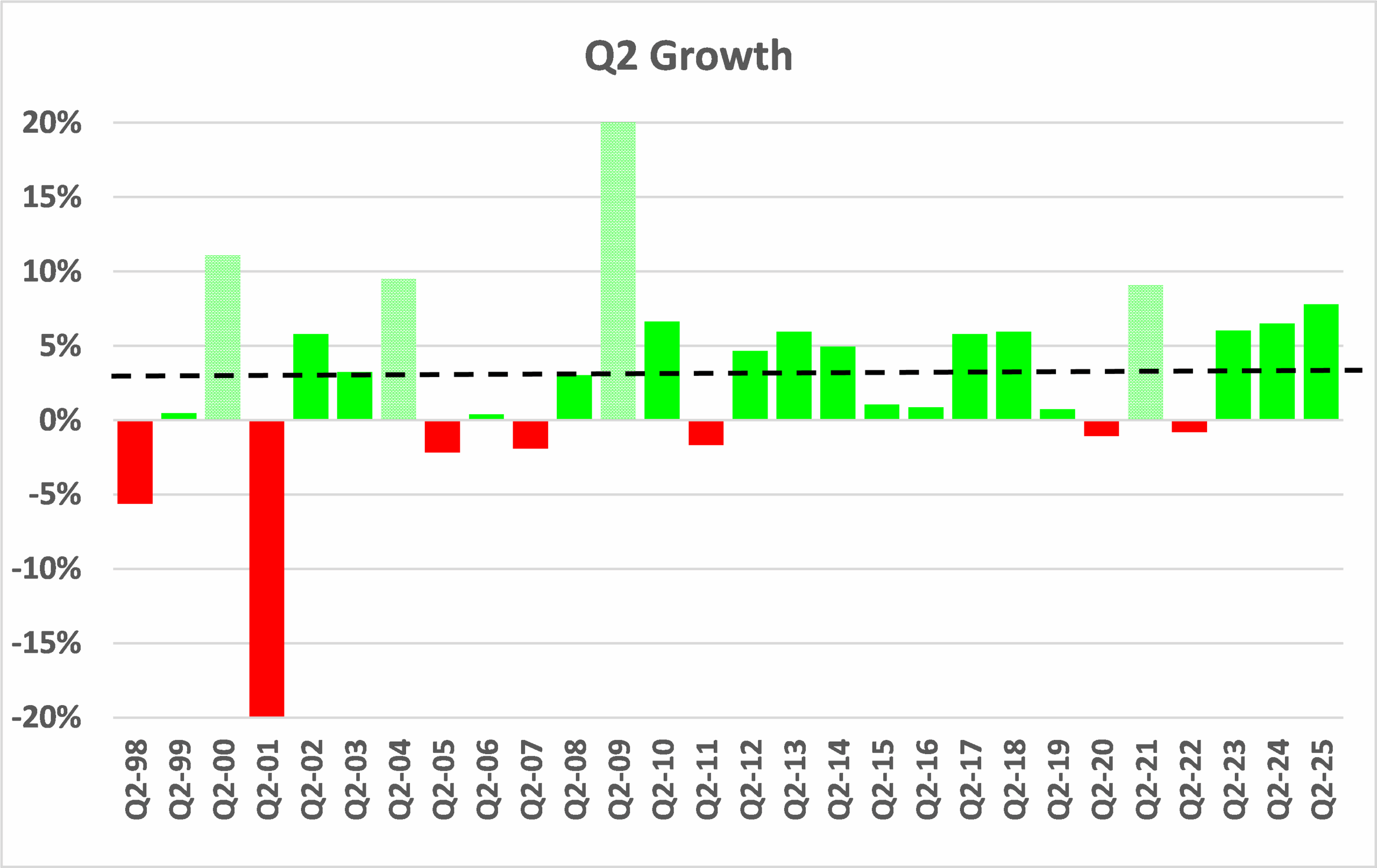

Q2 growth has averaged 2.9 percent since 1998, with only four results higher that Q2-2025’s 7.8 percent, namely in 2000, 2004, 2009 and 2021, each time at the height of a tight supply-side driven chip market boom, driven by capacity shortages and strong end-market demand.

Figure E11(b) – Q2 Growth Trend – 1998-2025

(Percent of US$)

Source: WSTS/Future Horizons

At the macro level, with the annualised sales of non-Memory ICs up 24.0 percent in June vs. 23.0 percent in May and 25.6 in April, and Memory ICs up 11.9 percent, vs. 17.5 percent in May and 23.8 percent in April, the annualised growth rates continue to paint a seemingly rosy outlook.

A deeper look under the hood shows a more confused and potentially bleaker picture. As has been the case since this current ‘boom’ started, the market has been driven by an economic anomaly of declining unit growth, resulting from the Covid-boom market shortages, but simultaneously increasing ASPs, in defiance of normal supply and demand economics and 70 plus years of chip industry history.

An even closer look reveals a deeply bifurcated market, one driven by the current AI boom and the rest, with the former comprising high-priced (for now) GPUs and exotic HBM products, both with near monopolist supply chains and deep pocketed, primarily data-centre infrastructure customers, immune to normal price-sensitive market pressures.

When your infrastructure investment programmes are costing hundreds of billions of dollars, the tens of thousand-dollar chip costs are lost in the noise. Not so if you are building a thousand-dollar smart phone or lap-top computer, or even a 100k dollar car.

Watch out for these high-prices ASPs to collapse, once the AI infrastructure boom runs its course, as it inevitably will. No boom lasts forever; all markets eventually saturate. In addition, pull-forwards are merely robbing future growth and stockpiles will eventually deplete.

As for the second-half year outlook, the current AI ecstasy, trade barrier risks, shipment pull-forwards and stockpiling are all clearly in play, which, along with broader economic concerns, have resulted in a potentially catastrophic atmosphere of heightened risk and uncertainty.

All this uncertainty, along with the on-going US tariff and trade flip-flops, is making the outlook for Q3 and the rest of the year increasingly unpredictable. The immediate key challenge is simply to ride and survive the current market tsunami.

At this point in the cycle, it would be wise to keep in mind Gordon Moore’s less revered second law, namely ‘Over the long term, the average IC ASP converges to $1’, or the fact the average revenue per square centimetre of processed silicon has been constant at US$ 9 since the advent if the IC.

If you are not selling these high-priced AI-related devices, you are currently living in a much different world, still bathed in recession, and more closely following the traditional industry trends.

Read The Full Report Here: https://www.futurehorizons.com/page/137/