Electronic Notes Launches Online Shop

Electronic Notes has announced the launch of its online shop covering a range of products from vintage valve mugs to Morse code mouse mats, and op-amp circuit mugs and coasters.

The launch of the online shop was built with electronics engineers in mind to provide products that engineers would want, rather than just reproducing logos. The shop is now live and can be accessed here.

It's great to see publications taking a slightly unusual route, extending their offerings and developing products that can be used by engineers and enthusiasts alike.

Certified for Success: How Our Digital Team Drives Success

In today’s B2B marketing landscape, success relies on more than creativity, it demands mastery of platforms and developing your skills. That's why our digital team undertake comprehensive training, gaining certifications that help boost their digital skills and knowledge.

As an employee owned agency we like to invest in our team, so what certifications does our digital team uphold?

-

Google Ads & Google Analytics (UA & GA4)

Every member of the digital team uses these tools to understand audience behaviour, optimise campaigns and drive ROI. -

LinkedIn

A platform which can be leveraged for targeted outreach, brand awareness and thought leadership. This is often an essential platform for several of our clients' campaigns. -

SharpSpring

Our teams expertise in automation workflows and email nurturing keeps us agile and effective in mid‑market campaigns. -

Oracle Marketing Cloud Academy

Our Head of Digital, Helen, supports the team in delivering scalable enterprise campaigns with precision. -

HubSpot SEO

A strategic approach to content optimisation, keyword tracking and SEO structure ensures our owned channels perform. -

Salesforce Marketing Cloud (Pardot)

Combining automated lead scoring with advanced campaign reporting helps support our clients' digital growth in the B2B landscape. -

Adobe Suite (AEM, Marketo, Analytics)

From content management to analytics, we ensure campaigns are both creative and measurable.

At Napier, our strength comes from combining tools, training and teamwork. Up-to-date certifications and weekly training sessions keep our team both well informed on digital developments and ahead of the curve. As a result, our team can deliver smarter strategies and, in turn, better results for both Napier and our clients.

Future Horizons: June Semiconductor Update

This month, we present the June extract of the Future Horizon's semiconductor report. Find out more about the current outlook of the market below:

Executive Summary

Annualised growth rates rebounded in April, with Total Semiconductors growing 22.8 percent, up from last month’s 18.7 percent number but still down from August 2024’s 28.5 percent cyclical peak.

Total ICs continued to be the star sector performer, at a healthy 25.1 percent growth up from 22.6 percent in March, with Opto at plus 16.0 percent, vs. minus 3.5 percent in March, and Discretes up 5.5 percent vs. March’s 0.9 percent decline.

Whilst the overall IC market still showed strong double-digit growth, the overall trend is flat, at around the 20 percent level, varying from August 2024’s 36.2 percent peak to January 2025’s 14.8 percent low. We expect to see this trend turn down in the coming months, as per past cyclical patterns.

Annualised growth rates are, however, just one side of the coin. Our preferred measure is the month-on-month revenue growth trends, which we believe are a more accurate reflection of the overall industry health.

From a market perspective, growth is still very much AI infrastructure driven, with the broader, more general, markets yet to recover from the post-Covid downturn. A worsening global GDP outlook could trigger a global recession.

This combination of circumstances is a perfect storm on steroids.

- GDP growth has been revised down, from 3.3 percent to 2.8 percent;

- There is no rebound yet in sight for a rebound in IC unit shipments;

- ASP are all falling, except for some yet unclear reason in Logic, and:

- Excess capacity abounds and is poised to get worse.

The broader industry dynamics are dreadful. Under normal industry conditions, short of a major geo-political or natural disaster crisis it doesn’t get much worse than this.

Read the full report here: https://www.futurehorizons.com/page/137/

Mark Your Calendar: ECF25 Returns September 2025

On September 16th 2025, the Embedded Conference Finland returns for its 7th year, taking place at Maria 01 in Helsinki.

Recognised as one of the leading events for electronics professionals in Finland, the event provides a platform for designers, corporate buyers, business leaders, and those interested in embedded technology to network and share the latest industry developments.

This year's agenda is packed with keynote speeches, technical presentations, and a panel discussion featuring industry insights. More details around the specific topics are expected to be released soon.

Registration for visitors is free, and you can register by clicking here.

The Ojo-Yoshida Report Has Rebranded!

The Ojo-Yoshida Report, a well-known voice in tech journalism, has rebranded as TechSplicit, a brand dedicated to exploring the global high-tech landscape, and the intended and unintended consequences of innovation and decisions within the sector.

Led by founder and Editor-in-Chief Bolaji Ojo, TechSplicit will investigate the greater implications of technology on markets, policy, economies, and society.

Joining Ojo in a new leadership role is Mike Markowitz, now Editor-at-Large. They lead an editorial team with over a century of combined experience in semiconductors and international tech.

TechSplicit will also expand its content offerings with a new podcast series and virtual summits on some of the most critical and high-growth areas of the industry including AI, semiconductors, power, and electronics lifecycle management.

It’s interesting to see this rebrand, as Junko Yoshida moves on from the news platform. We look forward to seeing how the publication and its content evolves with this change.

Meet Napier's Head Of Content: Q&A With Phil Gibson

‘This year marked 10 years since I first started on this journey, and I haven’t really looked back.’

Content is often at the heart of every campaign. At Napier, we often present our campaigns as 'content-driven', whether that be in a traditional PR format like articles, or a digital marketing format through LinkedIn or Google ads.

I recently chatted with Napier's Head of Content, Phil Gibson, who shared his journey into the industry and how our content creation capabilities support our clients.

Could you begin by telling me a bit about your time at Napier?

No good story would be complete without some sort of love interest, and mine is no exception.

It’s 2014, and I’m eking out a (very) modest living doing freelance copywriting by day, and pulling pints by night. Then I met a girl. The problem was that I lived in Guildford, and she lived in London. So on a Friday night, I would finish my shift at the pub and charge up the A3 in my tiny Peugeot 106 to spend the weekend with her, before coming back on Monday morning for my next shift at the pub. I kept this up for nearly a year, but also knew I had to find something more permanent (and better paid) to allow me to move in with my then-girlfriend.

Enter Armitage Communications, which in 2015 offered me a job right at the bottom of the ladder as a Junior Account Executive. Crucially, it enabled me to move up to London and start building a proper career for myself. A year later, my girlfriend became my fiancée, and in 2017, she became my wife (which bizarrely made headlines around the world).

In 2019, Armitage Communications was bought by Napier, which makes me (along with Ed, Helen and others) part of the Armitage alumni. By this time, I had progressed up the ladder from Junior Account Exec to Account Exec, and then onto Account Manager. But I was still known as a specialist copywriter, and it was only after Napier took us over that I was allowed to really spread my wings and focus on what I was best at – content.

Upon starting your agency career, what is the one piece of advice that stuck with you?

That there’s no such thing as a stupid question. It’s natural to feel scared of getting things wrong and receiving a telling off from the higher-ups. But it’s always better to check first and do something right than to get it wrong and have to do it again.

In relation to content specifically, a big part of my job is interviewing client personnel to either get a handle on the technical nuances of a story, or to add some personality and flavour, or both. I find that even in this environment, there are still no stupid questions. These people simply love talking about what they do, particularly when it’s to someone who’s genuinely interested, like I am – and so it’s incredibly rare that anyone is rude or impatient with me. I’d like to think that they also find it rewarding when that lightbulb moment occurs, and I suddenly get it.

What was your journey to head of content like?

So, about a year after Armitage became Napier, I was given a choice of what sort of specialism I wanted to pursue, between account management and content. Naturally, I chose content. With that said, because I can do both, I still manage some accounts of my own. And I’d like to think that because I’ve got a foot in both camps, I can bring a unique perspective when it comes to advising or suggesting ideas to colleagues and clients alike.

Today, I’m Head of Content Development, and I essentially run the content department at Napier. As well as making sure we’re always delivering content of the highest quality, I also manage both our in-house and freelance resources to make sure that we always have capable writers for every sector we operate in.

Have you always wanted to be a technical writer? How did you fall down this path?

I always knew I was good at writing and the English language, and so I hoped that I would end up using those skills somehow. But this agency (and its previous incarnations) found me, rather than me actively seeking out a role in B2B technical writing from the outset.

With that said, this year marked 10 years since I first started on this journey, and I haven’t really looked back.

What is a regular day like for the Head of Content Development?

A typical day for me will often have fewer meetings compared to others, but that’s because I need time to actually write content for clients. We’ve built a content team here that can handle pretty much anything, but I’ll often take on some of the complex and high-value projects myself to ensure they’re delivered to the highest quality.

When I’m not writing, I’ll often be in sourcing calls to interview client personnel, or discussing content resource planning with colleagues, or catching up with freelancers to brief them, provide feedback, and make sure that projects are staying on track.

Any writer will tell you that reading the work of others is vital to improving your own writing. Luckily for me, the content pipeline at Napier is so voluminous and formidable that there are always opportunities for me to look at what others are doing and try and find ways to incorporate the best ideas and approaches into my own work.

How can content creation support our clients?

I may be biased, but in my view, content is EVERYTHING. You can’t have a marketing campaign without content to underpin it. To speak to customers effectively, you first need a message worth listening to. At Napier, we have a vast range of marketing tactics that we implement, and the majority of them rely on having compelling content that engages your audience.

At the same time, I don’t believe in content for content’s sake – it needs to be outcome-driven. That’s where Napier’s 4-step process comes in useful to make sure that content generation is not just for the sake of it, but created to complement and drive the broader marketing strategy.

What is one piece of advice you give to new starters at Napier?

Probably the same advice that I received myself: There’s no such thing as a stupid question. That’s one of the cool things about Napier, that everyone is always willing to help each other out.

What is a project you're most proud of and why?

With 10 years under my belt, there’s quite a lot to choose from. The most memorable was probably when I got sent to Zurich at short notice to do some on-camera interviewing. Even though I spend most of my days interviewing people for articles and white papers, I’m more of a writer than a broadcaster by trade, and so this was somewhat out of my comfort zone. It’s one thing reading your questions off the page or screen, but having to completely freestyle it on camera, and look the part while you’re doing it, was a different beast altogether.

The videos that came out of that shoot were extremely high quality, which made it a rewarding project to be part of. And the whole experience of going out there, managing the client and the film crew, not to mention having to deliver on-camera, was something I found very exhilarating.

What do you feel your strongest quality is?

When you do what I do, you have to be a good listener, and you have to be able to get on with people. Sometimes when you’re interviewing people, it’s clear that they just don’t want to talk to you. Perhaps they’re busy, or they’re having a bad day, or they just don’t understand why they’re there. Sometimes, just asking the right question in the right way, or knowing when to let the conversation meander and when to bring it back, can help to open the floodgates and turn what might have started out as a difficult interview into a genuinely fun one.

What was your dream job growing up, and why?

When I was a kid, I wanted to be something different every day of the week. And I mean that quite literally: I wanted seven different jobs that I’d do for one day each week, so on Monday I’d be a train driver, Tuesday a footballer, Wednesday a bricklayer (don’t ask), and so on. Even from a young age, I always loved being creative and telling stories, and so one of those jobs, believe it or not, was “Writer”.

I may not have managed to achieve all seven in my life (although there’s still time), but to get to do one is definitely a win.

Entries For The Elektra Awards 2025 Are Now Open!

Entries are now open for the Elektra Awards 2025, which will take place on Tuesday, 9th December at the Hilton Bankside in London.

Now in its 23rd year, the awards feature 18 categories, with a new addition for 2025, the Neurodiversity Product Design Award.

The awards recognise and honour innovations and accomplishments by those shaping the industry, from start-ups to enterprises, and experienced electronic engineers.

Be sure to enter before the final deadline of 13th June 2025.

The Brightspark Awards entry is also now open. Celebrating promising young professionals (30 years old or under) in the electronics industry, the awards recognise those already making a difference in the first years of their careers, or those who are still studying but showing promise to become the leaders and innovators of the future.

Guest Blog - Kay Petermann's View On Canton Fair Visit In China

We were delighted to receive a guest blog from Kay Petermann, Editor of IEN DACH, who discusses his visit to the Canton Fair in China and his view on the event:

The opportunity to attend the 137th session of the China Import and Export Fair is a new and interesting experience for me. It is new after nearly twenty years of attending European B2B events.

Having attended European shows in the broader factory automation environment since I joined a B2B publishing company in the summer of 2006, this week has opened a new chapter in my career. I travelled to Guangzhou, China to attend the 137th Canton Fair as editor of IEN Europe. With its 55 exhibition sections and 172 product zones, this is the most horizontal event I have attended in my professional life; even the Hannover Messe, one of Europe's major spring events each year, has a fairly vertical selection of industries compared to this. Certainly, one of the first things you notice is the high level of internationalization, with buyers from more than 210 countries and regions.

China's industrial innovations in batteries, photovoltaics, digital technologies and intelligent manufacturing are represented with a focus on advanced technologies and green solutions.

One of the new highlights of the show is the Service Robots Zone, which showcases the latest developments and innovations. From manufacturers of joints and grippers that work like a human hand, to cobots and mobile robot units for the agricultural industry, harvesting fruit or vegetables such as tomatoes, they are all there. And that is not all. You can also find innovative designs for surveillance and detection, used for monitoring tasks in hazardous industrial areas, or for finding and rescuing people in a fire zone or after a natural disaster.

Another trend you can see, as at the European events, is that robots are becoming humanoid. When it comes to service and human-machine interaction, these design features clearly make sense, as they allow people to interact with a friendlier-looking machine. The benefits in industrial and manufacturing environments remain to be proven. However, a few years ago, nobody would have thought that a 20-inch multi-touch interface would be the way to go for machine operation, and you know what customers are demanding in terms of HMIs today.

With the growing investment in China's robotics sector over the next 10 years, the size and versatility of the Service Robot Zone at the show will certainly grow to the next level. I really hope to come back in the coming years to see this transformation and innovative ideas live and in action.

Future Horizons: May Semiconductor Update

We're happy to share this month's extract from the Future Horizons May report on the semiconductor market. Explore the latest market perspective and informed insights below.

Executive Summary

Annualised growth rates tapered off in March, with Total Semiconductors growing 20.6 percent, down from last month’s 20.7 percent number and August 2024’s 28.5 percent cyclical peak.

Total ICs continued to be the star sector performer, at a healthy 24.8 percent growth up from 24.1 percent in February, with Opto at minus 3.5 percent, vs. minus 2.3 percent in February, and Discretes dropping back into negative growth territory, at minus 0.9 percent, following last month’s short-lived excursion into positive annualised growth.

Whilst the overall IC market still showed strong double-digit growth, the overall trend is still one of decline, a downward trend that started from August 2024’s 36.2 percent peak seven months ago, Figure E1(a). We do not expect this trend to turn up anytime soon.

Annualised growth rates are, however, just one side of the coin. Our preferred measure is the month-on-month revenue growth trends, which we believe are a more accurate reflection of the overall industry health.

Worryingly, March saw monthly sales shrink 7.5 percent vs. February, reversing both last month’s growth and more severe that January’s 5.6 percent decline.

Even more worryingly, this decline was broadly spread across all IC sectors and the fact that March, being the last month of the quarter, is seasonally usually quite strong.

The key factor driving the 2025 semiconductor market continues to be an apparently insatiable AI data center server demand, the key factor that drove most of the 2024 market growth. So far, this sector shows no sign of slowing down, with the best-case scenario anticipating a strong, but significantly lower growth rate in 2025.

The outlook for the other key markets, such as smartphones, PCs, automotive and industrial, remains weak, and are unlikely to compensate for any slowdown in the AI-infrastructure deployment.

The global economic outlook for 2025 is not strong, especially with the uncertainty of the threatened U.S. increased tariffs on imports on global trade and other countries promising retaliatory actions.

The chip industry needs a strong global economy to thrive … we expect to be significantly downgrading our January 2025 forecast from 15 percent to single digits at our Spring Semiconductor Industry Outlook Webinar on May 13.

You can read the full report here: https://www.futurehorizons.com/page/137/

Editor of Power Electronics News Starts Two New Series!

Maurizio Di Paolo Emilio, the Editor of Power Electronics News, recently announced the launch of two new video series, Power Up Circuit Lab and ESD. These new series connect engineers, students, makers, and professionals in power electronics and embedded design. Using short videos, Maurizio engages with viewers to explore development boards, power modules, and test tools with clear, practical coverage of basic and advanced topics. He aims to use these series to bring together the industrial sector and maker communities.

It's no secret that journalists are extremely busy, and in such a fast-paced and at times chaotic media landscape, it is always impressive to see journalists like Maurizio creating and developing new ways to interact and engage with individuals within the industry. We look forward to seeing the series progress, educate and grow!

Future Horizons: April Semiconductor Update

We present this month’s excerpt from Future Horizons’ April report on the semiconductor market. Read on to discover the latest insights and outlook for the industry.

Executive Summary

Annualised growth rates turned up in February, with Total Semiconductors growing 20.7 percent, up from last month’s 14.8 percent, but still down from November 2024’s 22.8 percent high and August 2024’s 28.5 percent cyclical peak.

Logic continued to be the star sector performer, at a healthy 35.8 percent growth, up from 29.7 percent in January, with second-place Memory growing 26.6 percent, down from 29.9 percent in January.

Analog ICs moved back into positive territory in February, growing 8.8 percent, vs. minus 0.4 percent in January, as too did Total Micro, growing 2.6 percent up from last month’s minus 0.4 percent.

The overall IC market ended up growing 24.1 percent year-on-year, up from last month’s 19.4 percent number but significantly lower than November 2024’s 29.5 percent growth and August 2024’s 36.2 percent peak.

The overall trends, however, are still indicating retrenchment vs. recovery, having been now on a downward trend for the last six months. We do not expect this trend to turn up anytime soon.

Annualised growth rates are, however, just one side of the coin. Our preferred measure is the month-on-month revenue growth trends, which we believe are a more accurate reflection of the overall industry health.

Thankfully, February saw monthly sales grow 6.5 percent vs. January, reversing January’s 5.6 percent, December’s 8.7 percent and November’s 8.7 percent decline.

Even more thankfully, this growth was broadly spread across all IC sectors bar Analog, which is still gripped in recession.

Market Growth Indicators

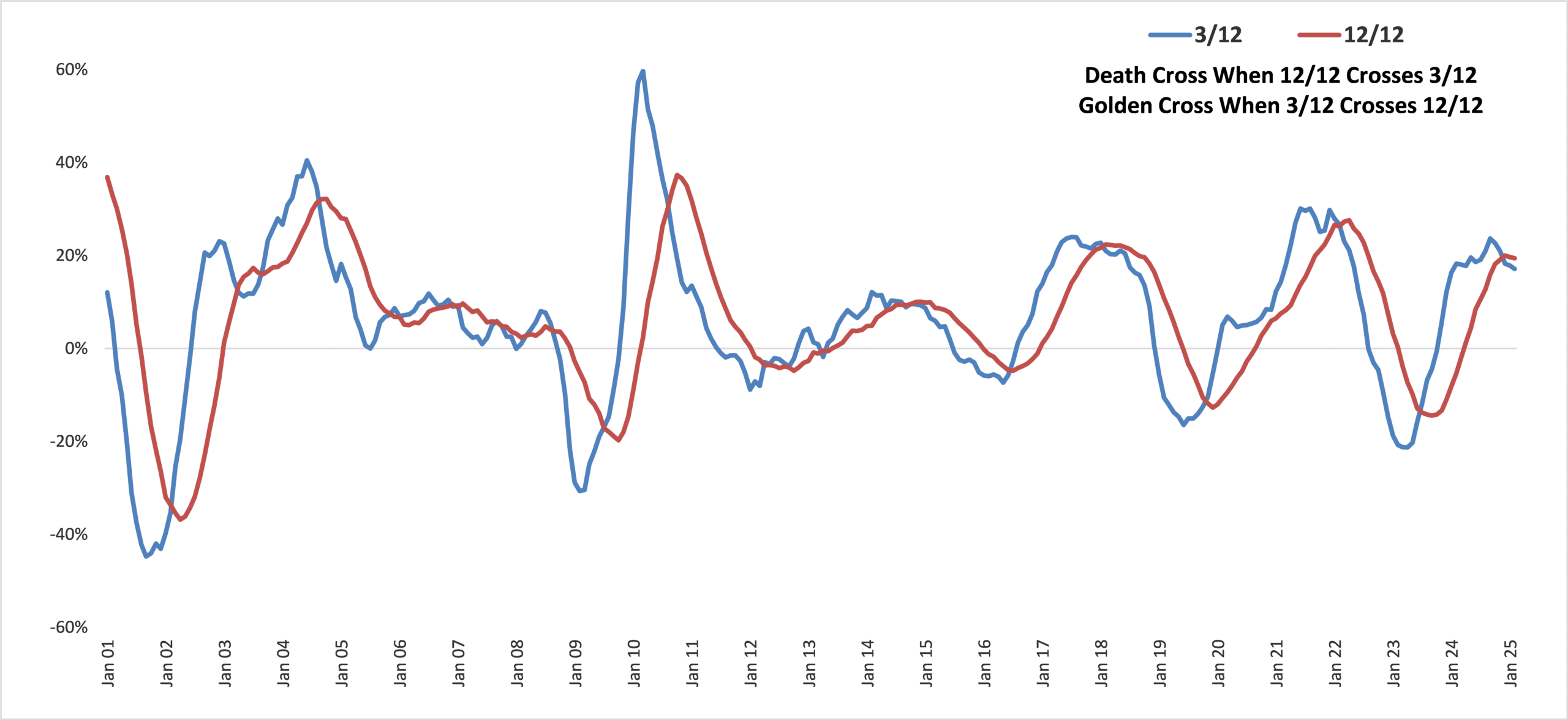

December 2024 saw the industry move into death cross territory, with the 3/12 curve declining further in February, to 17.1 percent, vs. 17.9 percent in January 2025, 8.2 percent in December 2024, and September 2024’s 23.7 percent peak.

At the same time, the 12/12 curve continued its gradual decline, at 19.4 percent vs. 19.7 percent in January and its 20.2 percent December cyclical peak.

As a result, the gap between the two curves widened slightly to 2.3 percentage points, vs. 1.8 percentage points in both January 2025 and December 2024.

WW SC Growth Momentum Indicator

(Jan 2001-Feb 2024 – Percent of US$)

There are three potential scenarios now in play, depending on how the 3/12 curve plays out.

Scenario 1: The 12/12 curve continues its cyclical decline but the 3/12 curve flattens off heralding a modest Golden Cross sometime in the mid- to late-2025, as in 2018.

Scenario 2: The 12/12 curve continues its cyclical decline with the 3/12 curve following its more typical decline trajectory, paving the way for an extended industry walk in Death Cross territory throughout the whole of 2025, as in 2014.

Scenario 3: The 12/12 curve turns back up whilst the 3/12 curve continues its decline, heralding a much stronger Golden Cross sometime in the first half of 2025, as in 2003.

At this juncture, it is hard to predict which scenario is most likely but, if the broader chip market continues its slow and modest recovery and the current AI-inspired boom does not crash and burn, then Scenario 1 is the most likely outcome.

You can read the full report here: https://www.futurehorizons.com/page/137/

IEN Europe Marks 50 Years

Congratulations to IEN Europe, which is celebrating 50 years of covering the industrial engineering industry.

From originally building connections through postcards, the publication evolved with the development of the digital age, launching the TIMLab Customer Zone. The online platform encourages communication between both sides of the industry, showcasing IEN Europe's commitment to educating industry suppliers and consumers.

With five decades of industry experience, the publication has and continues to actively explore emerging trends, technologies, and challenges that have defined the industrial landscape across the last 50 years.

Congratulations to IEN Europe on this monumental achievement. We look forward to witnessing the innovation and progress to come!

MVPro Media Launches North American Website

MVPro Media, the UK-based B2B publishing company specialising in machine vision and industrial image processing, has recently announced the launch of its North American website.

The new site will be a resource for those based in the US and will support the navigation of the evolving opportunities in the machine vision space. Focused on the future of industrial innovation, MVPro Media is for industry professionals, design engineers, manufacturing, production and quality control decision makers interested in optimising efficiencies.

It's always great to see the expansion of a publication, and the MVPro website in North America will be a great opportunity for the publication to showcase key insights, news and emerging technologies and products to its target audience in North America.

Electronics Weekly Launches Monthly Review Issue

Electronics Weekly has recently announced plans to introduce a monthly publication, replacing the current hybrid-news publication. Entitled, Electronics Weekly Review, the magazine will include thought leadership content and technical stories picked by the editorial team.

Readers will have access to exclusive worldwide electronics news, including market updates, the month’s top international News and analysis, and a distribution updates segment.

The new magazine will cover all areas of the electronics industry, from an emerging technology trends editorial section, to a new Education and STEM section which will highlight initiatives and projects to increase engagement in STEM.

Interviews with company leaders, upcoming members of the industry, inspiring individuals and entrepreneurs will also be featured, alongside a Blog Spot which will highlight the best of Electronic Weekly’s blogs.

“The investment in print means that the Review magazine is a true heavyweight with an arresting cover and strong editorial content,” said Electronics Weekly’s Editor, Caroline Hayes.

“The monthly frequency will allow journalists to provide a broader perspective of the industry, complementing the daily news we provide, and also present longer-form articles available exclusively to subscribers in a print or digital issue”.

It’s been a busy month over at Electronics Weekly HQ as they have also launched a new podcast, CHIIPS (Caroline Hayes’ Industry Insights Podcast). The podcast will feature discussions with industry leaders and personalities on topical subjects within the electronics industry.

The first edition of Electronics Weekly Review is due for distribution April 24th. We look forward to reading the new magazine and we wish the team at Electronics Weekly the best of luck with the launch!

Electronic Specifier Shines At Embedded World

Electronic Specifier partnered with #women4ew to co-host this year’s Women in Tech Forum at embedded world 2025. Held on 13th March in Nuremberg, Germany, the event brought together professionals from across the embedded systems sector to celebrate, inspire, and empower women in technology.

The forum featured an inspiring line-up of speakers who shared their experiences and insights on navigating careers in the tech industry. Helen Duncan, CEO of Blueshift Memory, delivered an engaging keynote, offering attendees a refreshing perspective on career progression. Sakshi Madaan, Product Manager at Anders Electronics, followed with her talk, ‘The Power of Perspective: Big-Picture Thinking to Drive Innovation’, which encouraged attendees to embrace strategic thinking as a driver for innovation.

The event also featured a panel discussion, moderated by Managing Editor of Electronic Specifier, Paige West. Joining the keynote speakers on the panel were Angela Raguse of Fraunhofer IIS, Stefani Eisele of Altera, and Nadja Eder of SchuhEder Consulting.

The panellists shared their experiences and discussed the evolving role of women in embedded systems, highlighting the importance of community and collaboration in fostering inclusive environments.

The forum concluded with a networking session, providing attendees the opportunity to connect, share experiences, and build lasting relationships.

The Women in Tech Forum has firmly established itself as a key event at embedded world.

Electronic Specifier also announced the winners of its Electronics Excellence Awards at embedded world 2025, of which entries were judged by a panel of thought leaders and electronics specialists.

The following companies took home the awards including:

- Power: Nordic Semiconductor – nPM2100 PMIC

- Electromechanical: NXP – i.MX 94

- Test & Measurement: Dukosi – DKCMS

- Passive: Swissbit – Security Upgrade Kit

- Software: Silicon Motion – SM2264XT automotive SSD controller

Congratulations to all the winners!

Engineers Trust Experts Over AI – What This Means for Marketers

The 2025 State of Marketing to Engineers report conducted by TREW Marketing, GlobalSpec, and Elektor International Media makes one thing clear: engineers look less at AI-generated content and more towards publications. Their recent survey of more than 1,000 engineers found that 67% rate their trust in AI at 5 or below on a 10-point scale, while 70% rarely or never use AI to evaluate vendors when making buying decisions.

As a result, 86% look for third party sources they know they can trust, including supplier websites, technical publications, and third-party reviews.

What can marketers learn from this?

That engineers, in particular, value authoritative voices.

The loyalty between engineers and individual authors, trade journalists and experts has never been more important, and is growing, in large part because we don’t believe that AI can replace human knowledge and expertise.

So, AI isn’t likely to kill journalism or marketing any time soon. But, what can marketers do to prevent it? The answer is simple: focus on building relationships with respected industry figures and publish verifiable content about products and services through their reputable outlets.

If you want to learn more about the survey’s findings, experts from Elektor International Media conducted a webinar on the 2025 State of Marketing to Engineers, which is available on demand here.

The State Of Publishing: An Editor’s Lament

This month, we would like to feature a guest blog from an anonymous editor who reflects on how their once fulfilling career has changed over time:

I’d been looking to break into technical journalism for some time, so when I won my first editorship in an aerospace manufacturing title, I was like an energetic rookie pilot on his first mission.

There was so much to comprehend in terms of the sheer size and scope of a competitive and vibrant industry that in terms of design and manufacturing technology, it knew no bounds.

The latest composite aerostructures, increasing integration of embedded electronics and environmental initiatives meant technology breakthroughs happened nearly as regularly as flights in and out of our busiest airports.

I travelled the world, met and interviewed interesting spokespeople who continually demonstrated that the industry was a hotbed for evolving innovative product designs – it was full of creative people thinking not only of the here and now, but of the aircraft of tomorrow.

However, things have come to a pretty pass when my role has now been reduced to the point where I’m simply editing ‘puff’ copy to keep the advertisers happy. The rise of social media, sales erosion, and swingeing financial cutbacks means it really has become a race to the bottom for the entire trade press publishing industry.

And now the sales tail is truly wagging the editorial dog. ‘Why did you travel to see [insert name/location here]? They never advertise’, wails the sales director. Oh, I’m sorry – I thought my job as editor was to source cutting-edge news/feature articles that would interest our readers?

Ah, the readers. I’d forgotten about them, hadn’t I?

I miss the press trips, the crazy food, the airport lounges, the press gifts, and most of all I missed the friendships and laughs. Nowadays, I’m made to feel like I’m something you shouldn’t step in, judging from sour-faced looks I get at some exhibitions. I find myself almost grovelling.

Whilst you can’t exactly call me a salesman, I’m now considered more of a ‘brand ambassador’ than an editor. Apparently, us editors now have ‘clients’. Oh, yes! The editor’s little black book of contacts doesn’t belong to the editor anymore – sales are privy to it too, so lead us to your ‘client’.

What was that old Reithian BBC saying? Inform, Educate and Entertain. The bottom line is, I don’t feel like I’m needed anymore.

embedded world 2025: The Results Are In

embedded world 2025 wrapped up two weeks ago, and despite last-minute travel complications, the show matched the success of 2024 with nearly 1,200 exhibitors from over 46 countries, showcasing their latest innovations and solutions to an impressive 32,000 visitors from more than 80 countries.

The accompanying conferences at the show also saw strong attendance, with 1,897 attendees from 47 countries.

Once again, the Napier team was among those attending the exhibition and conference in 2025. Seven of our team members travelled the halls, supporting many of our clients along the way. We met with over 30 editors across nearly 100 press meetings, keeping us busy, with the occasional opportunity to enjoy stand parties and network with publishers.

“The dynamism and innovative strength of the embedded industry were palpable in every hall—this shows how forward-looking embedded world is,” explains Benedikt Weyerer, Executive Director of embedded world. “With around 32,000 visitors from more than 80 countries and a wide range of innovative products and solutions, the trade fair was a lively meeting place for specialists and experts. The positive atmosphere and the many cheerful faces we observed in the halls and at the stands speak for themselves.”

It was fantastic to attend embedded world again with so many members of our team. The show remains at the heart of our industry and is the perfect place for both young and experienced engineers to expand their knowledge and gain unique insights into the world of embedded systems.

Be sure to save the date for embedded world 2026, taking place from 10th–12th March 2026 at the Exhibition Centre Nuremberg!

Future Horizons: March Semiconductor Update

We’re pleased to share this month’s executive summary from Future Horizons’ March report, featuring the latest insights and forecasts for the semiconductor market.

Executive Summary

Annualised growth rates continued their declining trend in January, with Total Semiconductors growing 14.8 percent, down from 15.9 percent in December and 22.8 percent in November, led by Total Memory, at 29.3 percent, a further sharp reduction from December’s 38.8 and November’s 87.2 percent numbers.

Logic growth was the star performer, at a healthy 29.7 percent growth, up from 23.1 percent in December, with Analog ICs losing ground at minus 1.0 percent, compared with December’s 3.3 growth.

Total Micro was also stuck in the doldrums, chalking up a 0.5 percent decline, albeit an improvement on December’s minus 2.5 percent growth.

The overall IC market ended up growing 19.3 percent year-on-year, down slightly from last month’s 20.3 percent number but significantly lower than November’s 29.5 percent growth. The overall trends are more favouring retrenchment vs. growth.

Annualised growth rates are, however, just one side of the coin. Our preferred measure is the month-on-month growth trends which we believe are a more accurate reflection of the overall industry health.

The picture here paints a much darker outlook, compared with the dizzy double-digit annualised monthly rates, with January’s sales down 5.6 percent from December, on top of November’s 8.7 percent decline. This decline was broadly spread across all industry segments, with Logic ICs the only sector seemingly bucking this trend.

Quite where the overall 2025 growth rate ends up will be determined by how much longer the current Hyperscale AI server market boom lasts. Were that to stumble, watch out for the annualised growth rate to implode.

AI aside, the overall chip market is now entering its eleventh quarter of recession since the Covid boom collapse in July 2022, with the high growth rate numbers propped up solely by the current AI-fueled market frenzy. All other mainstream product sectors are still wallowing in excess inventory and weak end-user demand.

History shows how difficult it is to spot the exact moment markets turn but the parallels between the current AI exuberance and the late 1990s telecoms network infrastructure bonanza remain uncannily profound, with the only obvious difference being most of the dotcom companies were ephemeral newcomers whereas today’s AI champions include some of the world’s most profitable and impressive groups including Apple, Amazon and Microsoft, as well as vNIDIA, the main supplier to the AI economy.

The sword of dotcom bust 2.0 hangs unnervingly from a thread. If the AI market were to even slow, let alone implode, it would take the chip market with it and our 15 percent growth forecast would overnight become a 15 percent decline.

Boom and bust cycles are often forewarned but past experiences are more often forgotten than learned and bad practices mostly unaltered.

You can read the full March report here: https://www.futurehorizons.com/page/137/

Future Horizons: February Semiconductor Update

We’re delighted to share this month’s executive summary from Future Horizons’ February report on the semiconductor market, which includes the latest industry insights and projections.

Executive Summary

Annualised growth rates fell back in December, with Total Semiconductors growing 14.5 percent, down from 22.2 percent in November, led by Total Memory, at 37.7 percent, a sharp reduction from November’s 87.2 percent number.

Logic growth was flat, at 19.4 percent, with Analog ICs at 2.5 percent, a much welcomed, if small, improvement on November’s 0.6 percent number.

Total Micro performed worse, chalking up a 1.6 percent decline vs. last month’s 1.0 percent lacklustre growth, bringing Total IC growth to 18.6 percent, or 10.7 percent excluding Memory, down from last month’s 22.2 percent and 11.2 percent respective results.

The monthly year-on-year annualised growth rates, which peaked in 28.0 percent in August 2024, have been falling now for four months in a row, Figure E1(a). We do not expect this trend to reverse anytime soon.

Following the euphoria of 2024’s AI-Hyperscale growth, the real market reality is now coming to the fore. Quite where the average 2025 growth rate ends up will be determined by how fast and by how much the ensuing monthly annualised growth rates will fall.

As can be seen from the 2021 to 2023 transition path, correctly guessing this number right is more lucky than good judgement.

Total month-on-month Semiconductor sales were 9.3 percent lower than November 2024, reversing November’s 10.3 percent growth. This decline was broadly spread across all IC sectors, as well as Total Opto, with Total Discretes the only product growth area, at 3.9 percent.

With growth wholly dependent on one market, namely AI infrastructure, even a minor misstep here would have dramatic ramifications for the overall chip industry. Right now, however, the AI frenzy shows no signs yet of abating, with the four big tech firms, Alphabet, Amazon, Microsoft and Meta all doubling down on their infrastructure investments.

This unbridled enthusiasm is, however, starting to see some pockets of scepticism and investor concern, as shareholders worry that doubling down on spending, without a commensurate increase in revenues, would starve non-AI business lines and eat into capital that would otherwise be returned to them as share buybacks and dividends.

Few people doubt AI is potentially game-changing but, correctly in our view, only if AI addresses a clear problem that needs a 10x advantage; has clean data to process; and overall compute costs decline dramatically.

Providing ChatGPT or GenAI features to search engines or MS Office only adds incremental value, it is neither disruptive nor game changing. As such, it offers little potential, if any, for increased revenue generation. It simply provides more bang for the same buck, one of the key fundamental hypotheses that has driven the industry since time immemorial.

If investor patience runs out, any pause or slowdown in the current AI infrastructure spend would trigger an immediate and dire bullwhip oversupply situation. From today’s undersupply backdrop, be it nVIDIA GPUs, SK-Hynix’s HBW memories, or TSMC’s CoWoS packaging, long backlogs and delivery times would be reined back dramatically, there is never a nice smooth inflection and no advanced warning.

Given the overall weak global economic outlook, the increased political uncertainties, and the risk of an AI data centre investment slowdown, following two years of hypergrowth, we do not expect to see the real semiconductor rebound before the second half of 2025 at the earliest.

Overall, we remain committed in our view that the more normal aspects of the market, now in their ninth quarter of recession, have yet to recover.

If the AI market implodes, even a recovery here would not be enough to save the chip market.

There is now a real danger 2025’s growth will go negative.

Read The Full Report Here: https://www.futurehorizons.com/page/137/

Show Focus: InnoElectro 2025, Budapest’s Leading Electronics Expo Returns

InnoElectro 2025, Hungary’s leading electronics event, returns from April 8-10 at the Budapest Olympic Centre. This flagship event will bring together industry leaders, innovators, and professionals from nearly 30 countries.

With the ever-evolving landscape of the electronics industry, staying ahead requires access to the latest innovations, insights, and networking opportunities. InnoElectro 2025 provides professionals with the chance to explore cutting-edge solutions, discuss industry trends, gain insights from top experts, and connect with key players in electronics.

Last year, the event attracted 2,500 visitors and nearly 700 exhibitors. Building on the success of InnoElectro 2024, this year’s event is expected to be even bigger, featuring 70 corporate booths and over 50 expert-led presentations.

A key highlight of InnoElectro 2025 is the one-day conference with the Surface Mount Technology Association (SMTA), focusing on advanced manufacturing technologies and industry trends. Other key topics include supply chain challenges, rising costs, and competition from Asian suppliers. Additionally, roundtable discussions will explore resilience strategies and nearshoring opportunities for European manufacturers.

The event stage will host industry experts discussing topics such as manufacturing technology, defence and aerospace, cybersecurity, engineering education, and the role of artificial intelligence in electronics design.

“This market deserves a truly professional exhibition. InnoElectro’s evolution has made it possible for everyone to see and, if appropriate, test the latest developments in electronics manufacturing and meet representatives of equipment manufacturers without having to leave the country,” says Csaba Berta, managing director of Danutek Kft.

The event also features the IPC Hand Soldering Competition, where Hungary’s best soldering expert will earn a place in the World Championship. A student competition will provide a platform for young talent to showcase their skills.

Free to attend, InnoElectro 2025 offers a unique opportunity to connect with industry leaders and explore the future of electronics manufacturing. Register online here.

Following the success of last year’s event, we look forward to seeing the impact of InnoElectro 2025!

Q&A with Napier’s Head of Digital Marketing, Helen Greenhead

‘What brings me the most pleasure is working with an incredible team of talented professionals.’

The world of digital marketing can be complex, but what makes digital marketing at Napier so unique?

I recently spoke with Napier’s Head of Digital Marketing, Helen Greenhead, to discuss her journey to her current role and how she keeps a level head amongst the constant changes within the world of digital marketing.

So what does Helen have to say about the industry?

Tell me a bit about your time at Napier.

I worked for a company called Armitage Communications for 27 years and then it was acquired by Napier several years ago, and I've been with Napier ever since.

Upon starting your agency career, what is one piece of advice that has stuck with you?

Not to stress over situations you can't change. There's no point stressing when you can't change something, and that has stuck in my head ever since.

What has led you to become an expert in digital marketing?

Well, I actually started out as a Database Developer, creating and looking after a number of databases for various clients. I guess this led to the start of my journey into digital marketing. I first got involved with the internet and emails in 1993. We started with one email account for the company, and it was my job to check it every day and make sure emails were dealt with. It was a game changer – to be able to send a client an email was like sending a letter electronically without relying on the postal system. Sure, we had a fax machine, but it didn’t provide the level of privacy or clarity that you could achieve with an email. I got a real taste for the internet and found it fascinating how you could have this facility to look up just about anything and it was there – a whole world apart from Teletext! I knew then that this was the field for me. I started to train on anything digital I could find.

My first digital platform was a web page creator. Working in databases, I already had a good knowledge of SQL, so when faced with HTML coding, it wasn’t that hard to get my head around. The new platforms just kept on coming and I couldn’t get my hands on them quick enough. Google Adwords - now known as Google Ads - was another game changer, a way to capture an audience by offering them collateral based on what they were searching for. They also offered a pretty good training programme, which I took advantage of.

Social platforms like Twitter - now called X- started to emerge and were yet another way to build and reach our audience. Over time we started to see a shift in the way that people requested information. The usual ‘form fills’, or bingo cards as we called them, found in the back of journals were slowing down – instead, we would place form links on web pages and push them out via both journal and social channels, for people to complete online. The telephone line requesting literature didn’t ring as often either as people found a quicker way to get their hands on what they wanted, without having to wait for the post. Marketing automation started to evolve, and I enrolled in training for certification in Oracle Eloqua. This was another game changer – now we could generate forms that would feed information directly into the database and enrol potential customers in nurture flows. Mapping out the customer journey from start to end, not only ensured prospects received the right information at the right time but gave us insights into where people were in the buying journey. And so, the real digital was born.

Digital marketing has evolved so much from when I got my first taste and has led to heaps of training. I now have countless certificates in different social platforms, SEO software and marketing automation. The training and certification are a must, but it’s also the experience and ability to be able to provide our clients with the best possible advice and insights for their campaigns, that really matters to me.

What is your day-to-day?

My days are busy! I always start the morning with a cup of tea – I cannot function without one. My next job is to check my inbox and respond to any emails that have come in overnight. There are usually lots of emails to go through as we have a global client base. Most of the time the emails require action, so either I deal with that directly or pass it to a team member, depending on the request. Usually, I have meetings booked in – on a typical day there could be 3 or 4 to attend. I oversee campaigns my team is working on and I am on hand for any queries they may have, including training on new platforms. I work on proposals with our account management team and provide the strategy for the digital campaigns.

Typical activities in a day could include mapping the customer journey for a campaign, managing the digital team, running reports, writing ads for paid media, and picking apart campaign results so that we can make data-driven decisions.

What is a project you're most proud of and why?

I had to think about this one because I'm actually proud of all the projects that come through the digital team but for different reasons. So, some make me proud because of the success of the campaign and some for the sheer volume of work that's taken place.

We did a campaign for ABB electrification, and we did it in 27 different languages. I'm proud of that one because it was such a mammoth job that so many people were involved in, and I feel we all came together. We created local language landing pages, emails, forms, and social posts.

As a team, we collaborated and came together, and we pulled it off and delivered a multi-language campaign. That makes me quite proud when I look back at the pages, I think wow, we did good there. It was a mammoth job, and we pulled it off.

What do you feel your best quality is?

I think anyone in Napier would tell you that I'm a calm person. If you're asking anyone that would be what they would say. I try not to stress over situations or tight deadlines because it's just so much easier to work with it and get on with it and do it. So, when I'm on the phone with other members of staff and we've got a big campaign going and they're stressing, I always say don't stress, it’s okay. That's probably my strongest quality.

Where do you see the digital department in the next 10 years?

I would like to see more growth in the digital team within the next 10 years. We know that digital is going from strength to strength and is only going to get bigger as it becomes more widespread. I would like to continue training team members in specialised fields so that we can continue to offer the very best in terms of knowledge and results for our client's campaigns.

What is one piece of advice you would give to new starters?

It was given to me and that is not to stress over something you've got no control over because if you can't change it, there's no point stressing about it.

Sometimes situations arise and you think, it can be stressful. But if you can't change it and you can't make any difference, why let it cause you stress?

What is something you have found to be unique to Napier and why?

I think Napier offers an excellent in-house training programme for both new starters and those who want to brush up on existing skills. I think that's unique because not many companies do that. Not many companies of our size will do. But I think that having that training in place for people that want it, I think is brilliant.

What makes the digital department at Napier so exciting?

We're always looking for the next big thing to happen in the digital world because it moves so quickly. We always like to look for new tools that we can play with and work with that will enhance our digital campaigns. All the campaigns that we run are different, and something exciting about that is seeing the opportunities that they bring to our clients.

What do you enjoy the most about your job?

Well, this is going to sound really cliché, but I love everything about my job. But what brings me the most pleasure is working with an incredible team of talented professionals and helping new starters to grow in their knowledge and expertise within the digital world. That's what I love most about my job.

If you had an unlimited budget for a campaign, what is one activity you would want to try?

Probably content syndication. We have used it once, and it is quite budget-hungry, but I think if you use it in the right context, it could be quite good. It doesn't work for every campaign, so it would depend on the campaign goals. If I had an unlimited budget I would also look to expand across Meta, because at the moment we tend to do LinkedIn, Google, YouTube or the traditional platforms. If we were, for example, running a branding campaign or some kind of recruiting campaign, I think Facebook would be good for that. But mostly, content syndication would be where I would probably want to play around a little bit more.

What is content syndication?

Content syndication is the practice of sharing content in multiple places using platforms like Outrun. It will serve on various journal sites depending on the interest of the reader. So, you'll have your ads, and you'll have your journal site and then depending on what the reader's interested in it will decide whether your ad will show or not, but your ads will appear down the bottom of the site, not on all journal sites, but on general sites that allow ads. So, it's just a way of getting a bigger reach; you can target certain journals as well, which is why you would need a big budget because the journal is worth targeting.

What skills do you think are essential for future success in digital marketing?

Because the digital world is dynamic and moves at a fast pace, the most important skill to have is the ability to change and adapt to the different things that are happening. If you're the sort of person who is stuck in your ways and can't change, then digital is not for you. But being able to move with the pace, move with the times and adapt to the different things that are going on is the most essential.

Electronic Specifier Partners with Embedded World’s Women4ew Conference

With only a few weeks to go until embedded world 2025, Electronic Specifier has announced that for the third year it will partner with embedded world’s “women4ew” conference, which has become a space for women in embedded systems to network, widen their knowledge, and support other women within the industry, Hosted and moderated by Paige West, managing editor of Electronic Specifier, the event takes place on Thursday, March 13th, and is sponsored by key exhibitors of embedded world 2025.

Electronic Specifier has a long history of partnering with women in STEM and launched a “Women in Tech” event two years ago, as well as developing a Women in Tech LinkedIn group.

Partnering with women4ew at embedded world 2025 is the perfect platform to support women in tech and reach others in the industry, whether they are women who have just started their careers in STEM or have been longstanding members of the industry. The three-hour conference will include insightful keynotes from an impressive array of speakers and a Q&A, providing attendees with the opportunity to ask industry experts questions and ignite new discussions. Those attending will also have the opportunity to continue their conversations and connect with other attendees after the event.

Paige West said, “We’re thrilled to be partnering with women4ew at embedded world for this fantastic speaking and networking event. Electronic Specifier believes in supporting initiatives that foster diversity and inclusion in the electronics industry.

“This collaboration between Electronic Specifier and women4ew helps provide a space for women in STEM to meet, grow, and learn. We look forward to seeing the results of the conference following embedded world 2025."

Event details:

Date: Thursday, 13th March

Time: 1pm – 3pm

Location: Start-up area, Hall 2

This collaboration between Electronic Specifier and women4ew helps provide a space for women in STEM to meet, grow, and learn. We look forward to seeing the results of the conference following embedded world 2025.

Vehicle Electronics Appoint New Media Representatives

514 Media has announced that they have been appointed as the new media representatives for the automotive publication, Vehicle Electronics. The company will handle the selling of advertising for the magazine and will be the first point of contact for advertising-related enquiries.

We look forward to seeing how this partnership supports Vehicle Electronics.

Elektroniktidningen Acquire New Head Of Sales and Marketing

Elektroniktidningen has welcomed Rainer Raitasuo as its new Sales and Marketing lead.

Rainer has been in the industry for over 20 years, having started his career as a Sales Manager at LPG Innovations. Since then, he has worked at companies like Future Electronics and Nordcad Oy.

Congratulations on your new role Rainer!